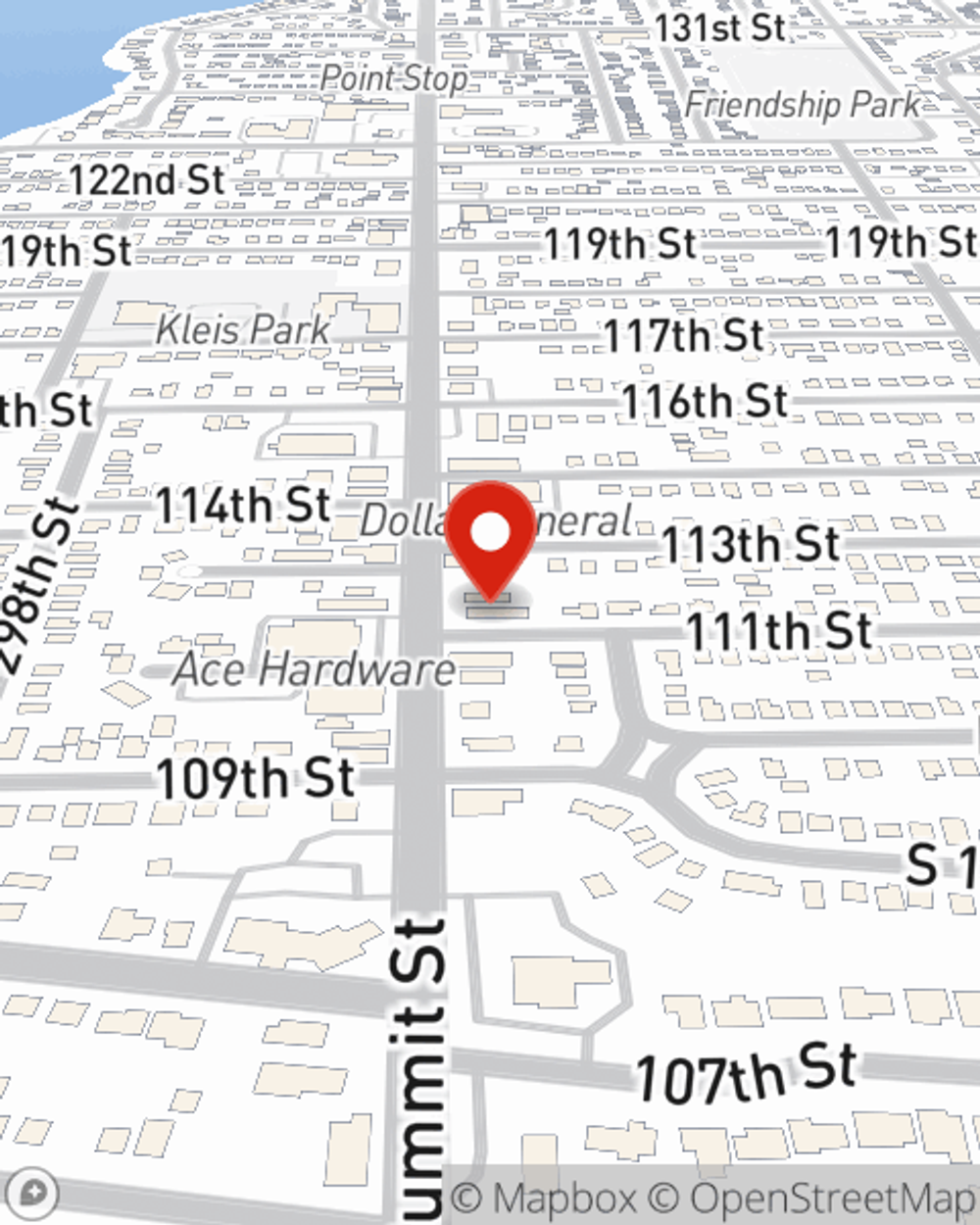

Renters Insurance in and around Toledo

Get renters insurance in Toledo

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

There’s No Place Like Home

Your rented house is home. Since that is where you spend time with your loved ones and make memories, it can be beneficial to make sure you have renters insurance, especially if you could not afford to replace lost or damaged possessions. Even for stuff like your stereo, towels, entertainment center, etc., choosing the right coverage can make sure your stuff has protection.

Get renters insurance in Toledo

Your belongings say p-lease and thank you to renters insurance

State Farm Has Options For Your Renters Insurance Needs

Many renters don't realize how much money they have tied up in their possessions. Your valuables in your rented home include a wide variety of things like your set of favorite books, TV, set of golf clubs, and more. That's why renters insurance can be such a good move. But don't worry, State Farm agent Scott Wood has the dedication and experience needed to help you understand your coverage options and help you protect yourself from the unexpected.

Renters of Toledo, contact Scott Wood's office to get started with your particular options and the advantages of State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Scott at (419) 726-3741 or visit our FAQ page.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.